Last week the Michigan Public Service Commission (MPSC) approved a $17.3 million rate increase for electric customers of Indiana Michigan Power (I&M), which, while still too high, represents another example of the MPSC demanding greater accountability for Michigan utilities because the commissioners cut the rate hike by 50% compared to I&M’s initial request.

“The MPSC is continuing its commendable trend of cracking down on utilities’ spending proposals,” Citizens Utility Board of Michigan Executive Director Amy Bandyk said in reaction to the MPSC’s order in this case (U-21461), as reported by MLive. The trend is continuing from recent decisions in rate cases for DTE Energy and Consumers Energy that also rebuked much of those utilities’ proposed rate hikes.

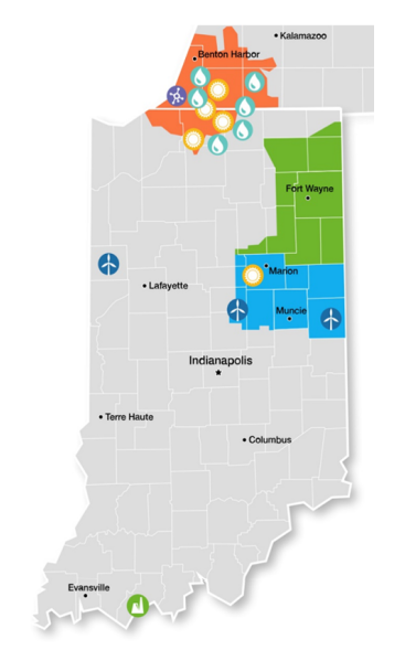

I&M, a subsidiary of American Electric Power, is the primary electric utility in southwest Michigan and serves over 100,000 residential customers in six Michigan counties. It also serves over 400,000 residential customers in Indiana, but this order only pertains to its Michigan service.

There are several specific victories from this rate case that are worth mentioning. One, as described by Bandyk in the MLive article, is that “I&M had asked that its return on equity, which is the return the utility is allowed to charge ratepayers to generate profit for shareholders, be increased from 9.86% to 10.5%, but the MPSC ordered that the return on equity stay at 9.86%.”

Another is that the MPSC rejected I&M’s proposed prepay program, known as PowerPay, in which customers would have been able to sign up to prepay their power bill in advance. The problem with PowerPay, like other prepay programs that CUB has opposed in the past, is that it may appeal to low-income customers who often struggle to pay their electric bills, but in practice is likely to hurt their interests and put them in worse financial situations, as argued in expert witness testimony sponsored by CUB from 5 Lakes Energy Senior Consultant Robert Ozar.

For example, the PowerPay program would have set the threshold for when a participating customer can have their power shut off to when their account hits a negative $50 balance. While at first glance that threshold may seem to make it harder for a customer to be disconnected, Ozar testified that the danger here is that negative $50 is likely to be the new $0 for those customers in the program.

“It is unrealistic to expect cash-strapped customers like those I&M is targeting for enrollment in PowerPay to carry a positive balance if they do not have to,” he testified. “With shut-off postponed until a negative $50 balance, it is reasonable to assume that many customers will ignore low-balance notifications as they approach $0 and maintain a negative balance as long as they can.”

What’s more, to restore service, a disconnected PowerPay customer must then repay the full $50 amount. “This means customers whose electricity needs have already outpaced their financial means will now need to find an extra $50 in addition to the funds to pay for future energy use,” Ozar said. “The negative $50 threshold provides no real protection against shut-off, in my opinion, and allows customers to fall farther behind than they otherwise would, thereby making it harder to afford restoration and future service.”

The MPSC made the right moves by not increasing I&M’s return on equity and by rejecting PowerPay. Still, the 4.13% rate increase for residential customers that the MPSC did approve is too high, considering how much I&M customers already pay and the service they receive in return. According to data from CUB’s most recent Utility Performance Report, in 2021 the I&M residential rate was 16 cents per kilowatt-hour, compared to 13 cents for the U.S. average. Meanwhile, the average duration of outages per customer for 2021 was 912 minutes, much higher than the 440 minutes for the national average, illustrating the highly unreliable service I&M provides.

The MPSC’s order was not silent on reliability concerns. The Commission directed I&M “to present findings in its next general rate case on its shorter pole inspection interval cycle for vegetation management and conduct a cost-benefit analysis on tree trimming,” the MPSC said in a statement.