New expert witness testimony filed in DTE’s latest electric rate case exposes how the utility’s proposed rate hike, one of its biggest ever, does not deliver value to customers and fails to take the steps needed to turn around DTE’s abysmal record on reliability.

This rate case is another example of how Michigan’s utility regulatory system has a built-in problem where utilities are biased toward bigger and bigger capital expenditures that provide a bigger return for their shareholders, but are not the most cost-effective way to improve service to customers. We have addressed this problem before, most recently in an op-ed in Crain’s Detroit Business, and also in blog posts about previous rate cases from DTE and Consumers Energy.

In this current case, U-21297, still pending before the Michigan Public Service Commission (MPSC), DTE claims it needs to increase rates by $619 million, which would translate to a nearly 14% hike on residential ratepayers. To give that number some context, DTE’s last four rate cases, going back to 2018, each have not increased residential rates by more than 5.4%. The company claims it needs such a big rate increase to pay for a “major capital investment program to improve reliability and resilience.”

Obviously, ratepayers are very concerned with power outages right now, so the question is: is the rate hike worth it to improve reliability and resilience?

The answer is no, according to the testimony sponsored by CUB, along with the Michigan Environmental Council, the Natural Resources Defense Council and the Sierra Club.

For example, testimony from 5 Lakes Energy Senior Consultant Robert Ozar takes on DTE’s plan to dramatically increase spending on distribution grid maintenance and capital investment. Essentially, that means spending more on the poles, wires and substations that make up the distribution grid, which are the components most likely to get damaged during bad weather and thus are behind most of the power outages. A big part of the utility’s plan is to boost spending on “pole and pole top maintenance and modernization” (PTMM) to nearly four-fold, from $31.7 million in 2021 to $120.6 million in 2024.

But, Ozar testified, DTE has not proposed anything to address the “substantial mismanagement of the program,” as shown by the huge backlog of inspections of poles and pole tops that DTE admits has built up. The fact that this backlog exists means that DTE does not really know the quality of the condition of many of its poles and pole tops because it has not inspected them yet. But with this ramp-up in spending, the utility is proposing to replace more of these poles and pole tops, even though many of them are not yet at the point where their condition has degraded to where they need to be replaced.

“The numbers speak for themselves – the massive dollar requirement being requested can only be rationally understood in terms of a projected massive scale of replacement of existing poles and pole top hardware, irrespective of whether the condition of such assets meet the two foundations principles of replacement, i.e., have failed (actual or incipient), or are in a state of imminent failure,” Ozar wrote in his testimony.

He found similar problems with other parts of DTE’s distribution plan.

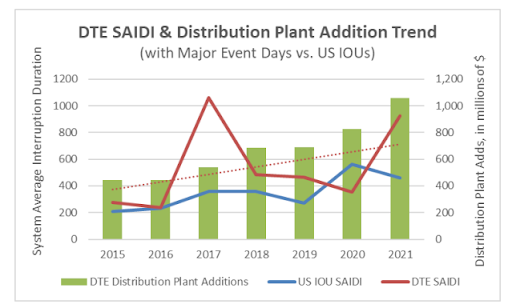

The image at the top of this blog post shows how the average outage duration in DTE’s service territory, as measured by the System Average Interruption Duration Index (SAIDI), has gotten longer even as DTE’s investments into the distributed grid have grown. The image came from testimony by independent consultant Dennis Stephens, who said that it shows that “increased capital spending has not been successful at reducing outage duration.”

Stephens recommended that the MPSC disallow DTE’s requested recovery of hundreds of millions of dollars of its planned distribution grid spending through 2026 on programs that Stephens argued were not shown to be cost-effective. “It is the Company’s burden to prove that these programs are either necessary for safe and reliable service, or that they deliver benefits to customers in excess of costs to customers. The Company simply does not meet that burden for these programs,” he testified.

Other testimony we sponsored included:

- Wired Group President Paul Alvarez on “how distribution grid planning as currently practiced in Michigan fundamentally shifts the shareholder/customer balance of interests decidedly in shareholders’ favor”

- Applied Economics Clinic Senior Researcher Tyler Comings on why the MPSC should disallow various costs related to the Monroe coal-fired power plant

- 5 Lakes Energy Managing Partner Douglas Jester on DTE’s poor performance on a number of metrics

- Energy Futures Group Co-Founder and Principal Chris Neme on the problems with DTE’s proposed pilot program for electrification of residential customers who heat their homes with delivered fuels like propane or fuel oil, and how the MPSC should require the program to be revised so it can better help electrify customers’ homes

The rate case will be pending throughout most of the rest of the year. An administrative law judge is scheduled to release a recommendation on the case in October, and the MPSC will make a final decision by the statutory deadline of Nov. 10.