In September of last year, the Michigan Public Service Commission (MPSC) released the results of a comprehensive distribution system audit conducted by third-party firm The Liberty Consulting Group (see this blog post containing some initial takeaways from when the audit was first released), giving DTE and Consumers Energy until mid-November to respond. The responses, both filed on November 15th, show that in many aspects Michigan’s two major utilities are in denial about the extent to which there is a major reliability problem in their service territories and what the most cost-effective and efficient ways to address the problem are.

On December 16, CUB, teaming up with the Sierra Club, the Natural Resources Defense Council and the Michigan Environmental Council, filed comments with the MPSC on the utilities’ responses that attempted to capture the degree of denial. The audit results show how both DTE and Consumers Energy’s grid management practices do not compare favorably to best industry practices. In addition, “across multiple programs, projects, and activities, both utilities plan novel and/or costly capital spending justified in the name of reliability but unsupported by realistic or proven projections of reliability benefits,” our comments said, emphasizing a point CUB has made many times before. This spending, if approved by the commission, would allow the utility to earn a high rate of return on its investment and mean significant rate increases for Michigan utility customers.

In contrast to the major utilities’ distribution system planning, the audit contains a “roadmap to achieving a grid that meets customer expectations,” as the MPSC put it, based on a thorough review of both utilities’ operations as well as analysis of applicable best practices that have worked at comparable utilities. CUB’s comments seek to show how the audit’s recommendations can start being implemented, lest the reports on DTE and Consumers Energy produced by Liberty “becom[e] two more regulatory reports that sit on shelves, obsolete before the ink is dry,” as our comments said. Here are some of the main points.

Consumers

Consumers’ replies to the points made in the Liberty report exhibited their level of denial about their poor reliability record. To counter Liberty’s finding that despite increases in spending in recent years Consumers has not improved its reliability according to standard metrics, the utility attempted to obfuscate reality by using a contrived metric which misleadingly showed reliability trends were moving in the right direction over the previous decade, as our comments explained.

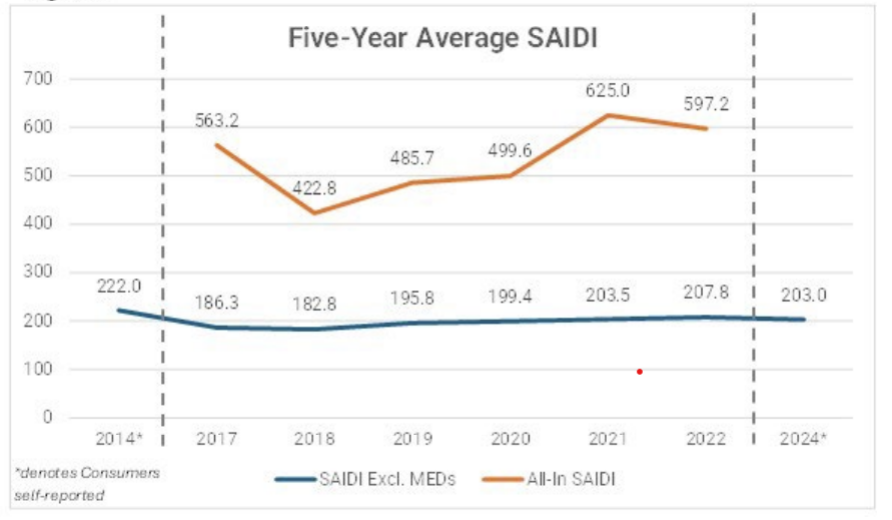

In its comments, Consumers also suggests its reliability improved more than that of peer utilities. Any credibility in this statement is based more on a technicality than on reality. Consumers has not improved relative to peers, despite its suggestions to the contrary. Our evaluation of utility performance shows that Consumers has consistently performed worse than more than 70 percent of its peers on one of the most important measures of reliability, the five-year average System Average Interruption Duration Index (SAIDI), which measures the average outage duration for each customer served.

SAIDI is measured in minutes of outage, so a higher SAIDI score implies longer outages and thus worse performance. The figure below (from our comments) shows that Consumers has failed to meaningfully improve its SAIDI over time, contrary to what the utility is saying.

In its response to the audit report, Consumers shows that it hasn’t used the Liberty findings to improve how it prioritizes investments in distribution system reliability. As CUB explains in its comments, “Consumers plans massive increases in unproven distribution capital spending without first seriously considering alternative strategies and cost-effectiveness.” This is problematic because, as previously discussed, increases in spending in recent years have not been shown to be effective in improving reliability.

One characteristic issue raised by the audit is the utility’s focusing too much on its distribution assets’ age when determining their health and replacement plans. For example, in its methodology for calculating the replacement of substation transformers, the utility uses both a transformer’s age and dissolved gas analysis (DGA) test results as decision making factors and disagrees with Liberty’s recommendation that age be dropped as a factor.

But, as our comments state, “the Company provides its own counterfactual for this methodology in stating that when transformers are starting to fail due to age, higher dissolved gases will appear in DGA testing. Therefore, DGA testing (which is a widely accepted industry practice) is sufficient for risk-profiling transformers. If a transformer is failing due to age, it will show in the DGA, thus essentially double-counting age in the current method. If a transformer is old but not failing, the current model will factor in age at a 14% weight for no reason.” CUB’s comments support Liberty’s contention that age be eliminated as a proxy for asset health in favor of inspection and actual condition-driven practices.

DTE

Although DTE called its response to the audit its “Implementation Plan,” our comments contend that the utility shows little intention of implementing several of Liberty’s key recommendations.

DTE responded to critical Liberty findings and conclusions with hollow reassurances and spin. Discussing its conclusion that DTE’s planned timeline for achieving its reliability goal is “too aggressive,” and should be delayed, Liberty provided several pages of analysis. DTE disagreed with the recommendation, stating that it “d[id] not agree that it is in the best interest of customers” without providing more information. DTE minimized the audit as just “point[ing] out that the plan is both ambitious and aggressive” and blithely proclaimed that DTE would “accept that challenge.”

Even when DTE claimed to agree with the audit report’s recommendations, it didn’t engage with them in a thorough manner, or seem to prioritize them. Although Liberty recommended that DTE “[a]dopt a four-to-five year visual overhead circuit inspection program,” DTE gives no specific timeline about fixing its lagging visual inspection cycle. The utility agrees that more frequent visual inspections should be a target, but rather than making a firm commitment, only says it will evaluate costs and impacts in a future rate case. This makes one question how serious they are about fixing it.

The Liberty audit report confirms many of our positions in our comments on DTE’s distribution grid plan and in past rate cases. DTE is spending too much, too fast on distribution capital investments without evidence that those investments improve reliability.

However, there are some points where our comments pushed back against Liberty’s findings.

For example, Liberty approved of DTE’s 4.8kV hardening program, which has been proceeding since 2018. As CUB has written about previously, most benefits of hardening derive from the first step in hardening – i.e., line clearing. By ceasing the 4.8kV hardening program and focusing on line clearing, the same increases in reliability could be achieved far more cost-effectively.

Additionally, Liberty recommended that the timeline of DTE’s 5-year plan to improve reliability be extended to 10 years. Although CUB agrees with Liberty’s characterization that the reliability improvement plan currently lacks a solid basis, CUB thinks that the target should be kept, as customers should not be put through another decade of continued poor reliability. Instead, investments should be redirected toward proven measures such as improved line clearing, increased maintenance inspections and condition-based repairs to achieve increased reliability targets.

Conclusion

As laid out above, Michigan’s major utilities are in a state of denial about the extent of their reliability issues and haven’t substantively taken the suggestions by the MPSC-commissioned audit into account in their distribution planning system efforts. To prevent the window of opportunity provided by the publication of the audit report from being wasted, our comments propose that ”the Commission should direct Consumers and DTE to identify in future distribution plans filed in Case No. U-20147 all plan elements contrary to or inconsistent with Liberty’s findings, conclusions, and recommendations and provide a detailed explanation for the divergence.” This measure would be a step in the right direction.